In a significant move to reduce regulatory burden on UK businesses, the government has introduced new legislation that will substantially increase the size thresholds for micro, small and medium sized entities. These changes, taking effect from April 2025, will allow thousands of companies to benefit from simplified reporting requirements.

Key Threshold Changes

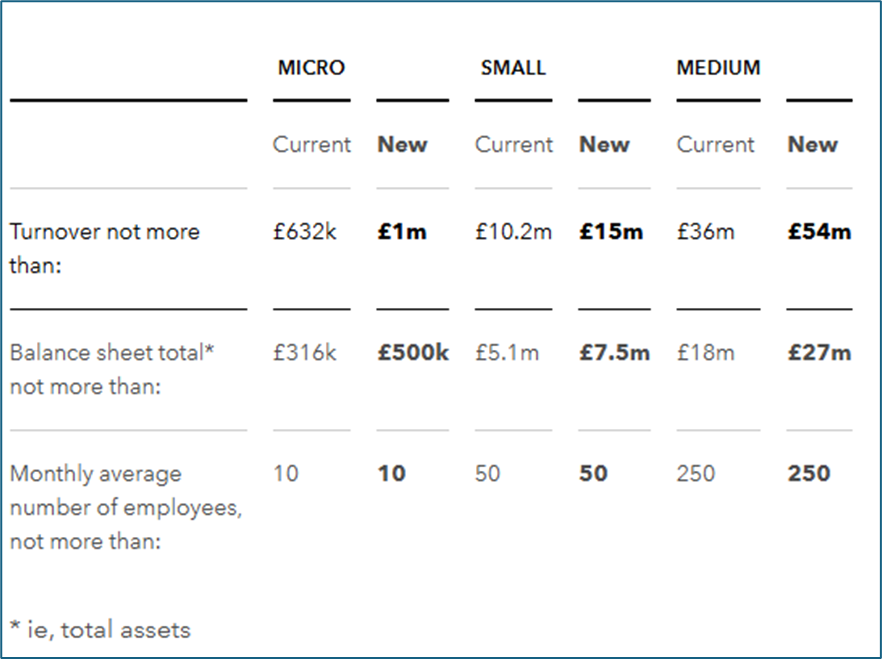

The new regulations introduce considerable increases across all company size categories. For micro-entities, the turnover threshold will rise from £632k to £1m, while small companies will see their threshold jump from £10.2m to £15m. Balance sheet thresholds are also increasing, with micro-entities rising from £316k to £500k and small companies from £5.1m to £7.5m.

Impact on UK Businesses

The government estimates these changes will affect over 130,000 companies and LLPs:

- 113,000 companies moving from small to micro-entity category

- 14,000 shifting from medium-sized to small

- 6,000 transitioning from large to medium-sized

This reclassification brings significant benefits. Companies dropping into a lower category will enjoy reduced reporting obligations and, in some cases, exemption from statutory audit. For instance, businesses newly classified as “small” will no longer need to produce a Strategic Report and can take advantage of simpler accounting requirements.

Streamlined Directors’ Report Requirements

The legislation also removes several requirements from the Directors’ Report for large and medium-sized entities. Companies will no longer need to report on various aspects including financial instruments, post-balance sheet events, future developments, research and development activities, employment of disabled people, engagement with employees, and customer and supplier relationships.

Implementation Timeline

The changes include a practical transitional provision for the “two-year consecutive rule.” When determining company size for financial years beginning on or after 6 April 2025, companies can assume these new thresholds applied in the previous year, allowing for immediate benefit from the changes.

These reforms represent the most significant update to company size thresholds since 2013, reflecting the impact of recent years’ inflation and the government’s commitment to reducing complexity in business reporting. For many companies, this will mean substantial cost savings and a welcome reduction in administrative burden.