Auto Enrolment is changing – Are you aware?

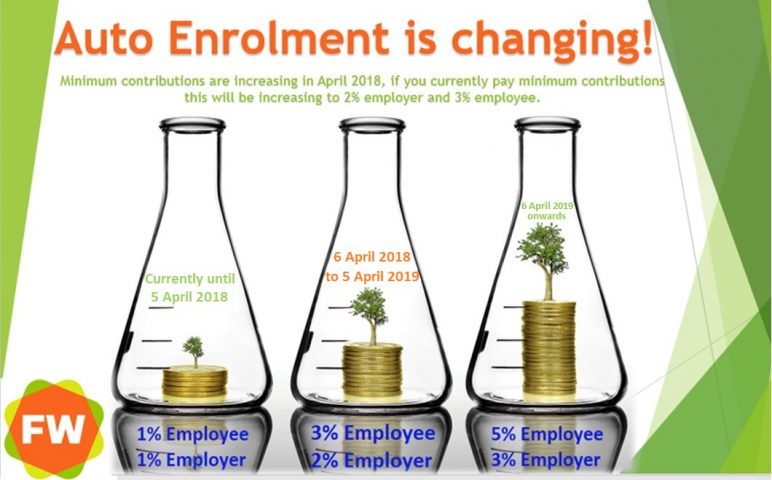

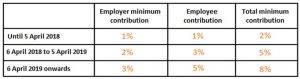

From 6 April 2018, minimum contributions are increasing for Auto Enrolment. By law, the employer must pay a minimum contribution of 2% and the employee has to top this up to the required total contribution of 5%, meaning employee contributions rise from 1% to 3%.

If the employer pays the minimum total contribution (5%) then the employee will not need to make any contribution, unless the scheme rules requires them to do so.

These increases are a legal requirement and changes will need to be made in April in order for the scheme to remain a qualifying scheme. If the contributions are below this level the scheme may not be used for automatic enrolment.

Both the employer and employee may choose to pay more than the minimum contributions if they wish. If your pension scheme already has contributions of more than the total minimum contributions no changes will be needed in April.

There are no additional duties requiring employers to advise employees of the changes, but it would be a good idea to do so to minimise queries.